Interviewed By Emmanuel Daniel

Heads of digital asset banks and Hong-Kong based virtual asset exchanges discussed the future of asset tokenisation at the closing session of The Asian Banker Summit 2024 held on 23 May at the Conrad in Hong Kong.

During the session, From virtual to real: Exploring the evolving landscape of virtual economies and digital assets, panellists talked about successful partnerships with traditional financial institutions to enhance product lines using cryptocurrency, and working with regulators to create alternative investment options for asset managers.

Gerald Goh, co-founder and CEO of digital asset bank Sygnum, said there are plenty of opportunities for traditional banks that want to expand their offerings to include digital assets through white label products.

He said: “We are currently the market leader in Switzerland in terms of B2B or bank-to-bank white label offerings. Swiss banks can use us to enable their end clients to buy, sell, and custody digital assets—primarily crypto at this time—with us, Sygnum, at the back as a fully-regulated banking white label service provider.”

By partnering with Sygnum bank, traditional banks can launch their own crypto offerings by integrating Sygnum’s B2B platform into their existing infrastructure.

Sygnum, headquartered in Switzerland and Singapore with presence in United Arab Emirates and Luxembourg, has a 1,900-strong client base made up of institutional and accredited investors. The latest client it onboarded is PostFinance, one of the largest retail banks in Switzerland with 2.5 million clients, or about a third of the Swiss population. Partnering with Sygnum gives clients access to round-the-clock trading and custody of cryptocurrencies. Using ATM cards, clients can also buy crypto at terminals.

Other than white label services, Sygnum also provides fiat loans collateralised against crypto.

Goh said: “What we are building is a universal bank for digital assets. The bulk of my revenues are now generated from onboarding digital asset-focused corporations. Banks can make money in the digital asset space. It’s classical banking that got us to where we are.”

Kevin Loo, CEO of DigiFT Hong Kong, an exchange for asset-backed tokens, said that other than crypto, there is a world of possibilities in the tokenisation of real-world asserts.

Headquartered in Singapore, DigiFT is licensed to mint security token offering (STO) backed by real world assets like bonds and equities on a public chain. Loo said: “We’re an exchange for STOs, which have the same risk as securities. It trades in a different backbone, different infrastructure on blockchain. The settlement is slightly different but it’s security at the end of the day

“Our founder Henry Zhang would like to describe us as the Amazon of Web3 finance. We can tokenise direct assets, t-bills, money market funds. We can also do a whole bunch of Web3 funds, moving across the maturity spectrum and up and down the credit ratings spectrum. “

Anthony Ng, co-founder and CEO of Hong Kong Virtual Asset Exchange (HKVAX) said digital asset exchanges present opportunities to asset managers having trouble entering the mainland China market because of strict currency controls and unfamiliarity with the business culture.

He said: “Investment companies want to allocate resources in mainland China assets. They are concerned that if they make direct investments and convert their fiat money into Renminbi, they cannot (easily) get their money out after making money because of currency control.

“Second, if they invest in the stock market, they face risks like the Evergrande crisis. They also feel that they do not understand Chinese culture and corporate governance in mainland China, so they are a bit hesitant. Bonds are common but then some property builders default on their obligations. How can they allocate their resources in mainland China in this case? We as an exchange can tokenise assets.”

On the central banking front, the Bank for International Settlements (BIS) has ongoing projects with central banks worldwide on solving some of the key inefficiencies in cross-border payments such as high costs, low speed and transparency, and operational bottlenecks. One of these initiatives is Project mBridge which aims to establish a multiple-central bank digital currency (multi-CBDC) platform for wholesale cross-border payments.

Hakan Eroglu, adviser for Innovation Hub at BIS, said: “We work with central banks so all our projects are launched with central banks with the angle of solving cross-border issues. We are leapfrogging towards a new way. You have assets and you have to move them but we have limitations in the current financial market infrastructure. It’s a technology problem but we also face some regulatory topics that jurisdictions need to look at and where collaboration is required.”

The closing session was moderated by Emmanuel Daniel, founder of The Asian Banker, and co-hosted by International Resource Director Gordian Gaeta.

On June 21, The Asian Banker held the 2024 Future of Finance China Summit in Beijing, themed "Challenges and Vision". The year 2024 is expected to be a challenging one globally due to intensified geopolitical tensions and increased trade…

At the Finance Thailand Leading Practitioner Roundtable 2024, industry leaders discuss strategies to address the high costs of regulatory compliance, technology modernisation challenges, and the importance of strategic collaborations in…

Industry leaders at The Asian Banker Finance Vietnam Leadership Roundtable 2024 discussed modernising core banking and payment systems to boost operational resilience, financial stability, and hybrid cloud adoption to address legacy system…

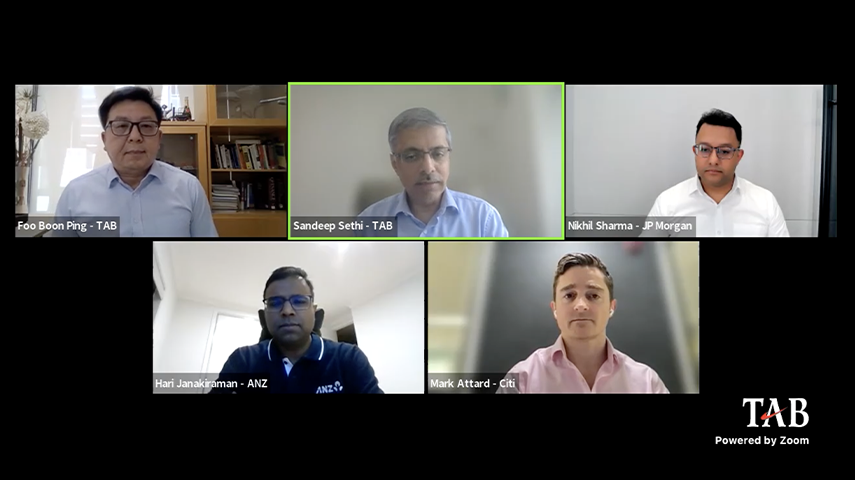

During this RadioFinance session, we explored asset tokenisation and the digital asset world from the perspective of the global banking industry, highlighting key trends and challenges and how it is helping evolve finance.

At a recent roundtable hosted by The Asian Banker, industry experts from banks and financial institutions across Asia offered a comprehensive overview of the current challenges and potential solutions in cross-border payments.

By continuing to browse this website, you agree to our privacy policy.